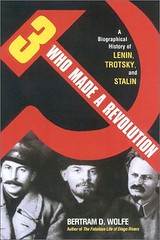

Three Who Made A Revolution

Sometimes an institution is weak.

It might be large and long-standing and do business as usual, but, really, it has little strong support from the people within.

And all it takes is a visionary leader who is willing to break the rules to take it down.

Most people are not aware that there were two Russian revolutions in 1917.

The first was in February. Some women workers started demonstrating for bread and, soon, everyone was in the streets.

To everyone's surprise, the Tsar abdicated and governmental power was divided between the Duma, which was the existing popular assembly, and the new parliament of left-wing parties, the Soviet.

No one planned on a second revolution, not even the Bolsheviks. The next step was to be a constituent assembly which would write a constitution.

But, then, Lenin returned from exile determined to take all power for the Soviets. And he did.

The Lenin of Bay Street

Likewise, Dave Kassie. The CIBC is a huge institution. He is just one man. But he knew that the giant was a house of cards and that if he set up a competing business, he could draw its best and brightest to his team. And he did.

But, why were people so willing to leave?

Andy Willis asked the same question:

- Anyone else wondering just what Genuity Capital Markets

has got that makes it simply irresistible?

Kassie believes in the magic of a company

owned by the workers themselves.

Here's how Andy describes it.

- Genuity is a cake built in two layers.

There's a parent called Genuity Financial Group,

where the investment banking types hold their stakes.

There's also an operating subsidiary,

Genuity Capital Markets, where only the trading,

sales and research staff hold shares in addition

to their stake in the parent.

Such a structure gives these employees a more direct-drive

compensation system than is commonly seen...

If they capture a great deal of institutional trading,

they'll prosper, no matter what the rest of the firm is doing.

and sums it up in three points.

1. Bank-owned dealers can't offer partnerships

whereas Kassie can.

2. Genuity has an attractive, positive atmosphere.

Banks don't like their investment firms' wholesale operations.

The profits are erratic whereas bank CEOs are "obsessed with presenting predictable and steadily rising earnings to shareholders."

3. Kassie's timing was exquisite.

Bank mergers are invevitable. If the Royal Bank with its RBC Capital buys Bank of Montreal, BMO Nesbitt Burns will become redundant.

And "Genuity could bag a Big Five

wholesale operation on the cheap".

All this from the actions of one bold man and his able lieutenants.

Source articles

Eric Reguly: Globe & Mail Dec 24/04

Andy Willis: Globe & Mail Jan 11/05

See Also: GenuityGang Strikes Back -- CIBC Recruiting Scandal -- David Kassie, Kingpin -- David Kassie's Dream -- Dan Daviau -- Earl Rotman -- Kassie Defiant -- Phil Evershed -- Hirst, Morrison, Eggertson -- Marie Cordero -- Bad 4 Recruiters -- Sweet Marie -- The Kassie Cult -- Kassie Honoured -- Hunkin's Millions -- BlackBerry Got 'Em -- Kassie Family Hunted -- Blackberry Mystery Solved -- The Genuity Revolution -- Technorati Tag: Genuity

No comments:

Post a Comment